🔵 The majors, the indies... and the "mindies"?

How the landscape is changing and how indie labels could capitalise on that.

I’ve written a fair bit of late about the indie music ecosystem, with plenty of reference to trade bodies and a general sense that much of the current system feels oddly paralysed in 2024. I guess a simple summary would be “too many trade bodies with little common ground, and therefore little market power being wielded”.

This had me contemplating various companies within the independent space however, and that in turn made me realise that perhaps these days the landscape is not as simple as just being a major label or an independent music business.

Believe and BMG might be two cases in point; companies I’d argue are now looking more like “major indies”, or “mindies” (hat tip, Eamonn Forde!), that is, music businesses who are not yet able to compete with the likes of Sony and Universal, but who are fairly certainly growing at a rate that could conceivably make them a contender in time.

Someone once remarked to me that Believe could, within 8 years or so, be of equivalent size to Warner Music. I could see that happening, based on the company’s current trajectory. This is also why I can see the logic to the company’s board and CEO looking to take the company back into private control. For me, it is an interesting statement about the schism between investors looking for constant growth, often at absurd rates, versus businessmen with more experience in their sector, who understand that growth may require moves that perhaps don’t align with the needs of those on Wall St.

Could BMG go up for sale too? Anything is possible these days, and whilst I’m not seeing obvious signs of it, it doesn’t feel like a ridiculous notion to entertain; the Bertelsmann family did sell up once before, to Sony, lest we forget. Perhaps this could be where Believe may see a move in some kind of merger to finally take on the three incumbent majors. Who knows.

What it does suggest, however, is that these companies will continue to grow and that in time it is plausible that we might see a return to the pre-piracy days of the nineties where there was more than three majors.

Where would that leave the “real” indie music companies then? By which I mean, the likes of Beggars and Domino; businesses built with a more complete focus on recorded music without broadening their investments to take in companies like Tunecore, which I’d imagine is now a solid contributor to Believe’s bottom line?

It poses an interesting question, but also, I suspect, highlights the possible difference in vision between the indie record labels and the indie music conglomerates like Believe. Beggars and Domino are great examples of companies that have succeeded the traditional way, i.e. by signing incredible artists and selling formidable volumes of albums. Believe, on the other hand, has certainly seen recorded music success, but has also diversified into the DIY space via Tunecore, acquired distribution companies, invested internationally in places like India and more. Its revenues are far more diffuse.

Bringing this back to trade bodies, it leaves me once again thinking where the power lies and whether, in reality, the music sector represented by anyone who is not a major label can actually come together at all.

The bottom line is that - in my view anyway - the likes of BMG and Believe simply do not share the same ideologies as the bigger indie labels. That is a problem, at least in the context of finding market power and operating under any kind of common cause.

Perhaps the reality is that there is no common ground. However this might also speak to an opportunity, namely for indie labels to recognise a need to cut through the sheer saturation of recorded music being released by presenting themselves as gatekeepers of a sort.

This is also why I think it might be time for indie labels to recognise that need for gatekeepers to exist again. There is too much music now, and a desperate need for those valued filters that provide far higher-value connections than any algorithm can provide.

The times are changing then, and with it, opportunities abound. Maybe the strong, successful indie labels of the future are those that broaden their horizons to own other spaces within the ecosystem, as Beggars did in the past with its investments into the Rough Trade shops, but this time focusing on storytelling, recommendation and connection.

I’ve no idea what conversations go on behind closed doors regarding this kind of thing. I know I’d love to take part. I just feel there are so many ways that indie businesses can create something truly formidable that focuses on quality, and story telling, and experience. The majors and to an extent the “mindies” like Believe are going for volume. Perhaps the long game win here is simply in substance. Celebrate how music makes its most valuable connections with human beings, and speak to that. Human connection and experience is becoming more and more valuable as the Age of AI creeps upon us. Speak to those values and surely you cannot go wrong.

Have a great evening,

D.

🎶 listening to “Juke Box Baby” by Alan Vega. I don’t even know why I like this song. It is unquestionably catchy, bizarre and somehow enthralling at the same time. I think it’s the fact that it is Vega - he of the legendary Suicide - that made it is what’s so disconcerting. Anyway, I love it.

📺 watching “AI Music Has a Dangerous Theft Problem” by WeaverBeats on YouTube. This is an interesting angle, though I’d argue the voices and music being used as examples are so painfully generic that it probably isn’t all that hard for AI to replicate that. Nonetheless, interesting and worth a watch.

🤖 playing with piping custom GPTs into Slack for the purposes of completing various simple tasks. One I’ve been experimenting with lately is using it to take a transcript of a call and turn it into proper, professional meeting notes with action points. So far it’s proving highly effective.

Stories from the Music Industry:

NMPA accuses Spotify of ‘attacking songwriters’ as streaming service changes how it pays out mechanical royalties in the US

Spotify has confirmed that a big change has arrived to the way it pays out mechanical royalties in the US, as it now considers its Premium plans to be ‘bundles‘ – because they combine audiobooks and music. Treating Premium (including Individual, Duo, and Family) as a bundle rather than a standalone subscription impacts how the company pays mechanical royalties to songwriters and publishers in the US. In short: The rate now paid for Spotify’s Premium plans is lower than the headline rate for a standalone subscription agreed with publishers as part of the CRB IV proceedings.

👆🏻Hot take: this kind of move might well bite Spotify on the backside at some point in the future. On the one hand I don’t blame them for acting as any giant corporation would, but at the same time, quit claiming you have the interests of creators at heart, because moves like this clearly suggest otherwise.

Believe’s board backs takeover bid from Denis Ladegaillerie-led consortium

Believe’s board of directors – excluding those who are involved in the consortium, or have already agreed to sell their shares to the consortium – voted unanimously to offer a “favorable opinion” of the offer, as it’s “in the interest of the company, its shareholders and its employees,” the company said in a statement issued on Friday (April 19).

👆🏻Hot take: could Believe become the new “Mindie” (Major Indie) soon? I wouldn’t bet against it, and that raises all manner of interesting questions.

Hipgnosis story takes a new twist as Blackstone makes bid

“Blackstone is seeking to find a positive outcome for all shareholders at a fair and reasonable value; however, Blackstone and HSM value the contractual protections under the IAA [the investment advisory agreement] and will vigorously defend HSM’s rights pursuant to the Option if required to do so.” In other words: agree to sell Hipgnosis Songs Fund to us rather than Concord, or the gloves come off legally speaking. Which could get interesting if Concord comes back with a higher offer than Blackstone’s now…

👆🏻Hot take: I still feel history will look back on this entire situation and marvel at just how Blackstone and HSM managed to get that clause in place which will now do a stirling job of ensuring no one else attempts to buy the company. The legal mess this could create for Concord is immense.

Spotify subscriber base grew by 3m to 239m in Q1, as company posts biggest ever quarterly profit

Spotify saw its global Premium Subscriber base grow to 239 million paying users in Q1 – and achieved its biggest-ever quarterly profit in the three months to end of March. That’s according to the company’s latest financial results (for Q1 2024), filed today (April 23), in which SPOT reported that its Premium Subscriber base was up 14% YoY, and up by 3 million net subscribers on the 236 million that SPOT counted at the end of the prior quarter (Q4 2023).

👆🏻Hot take: great news for Spotify shareholders. For everyone else, at a point where the payout rate per stream is at its lowest ever? Not so much.

Proper, formerly Utopia, tells shareholders: We need $6.4m from you

In a letter sent by the Proper Group Board of Directors to shareholders on Wednesday (April 17), seen by MBW, the company noted that it held an investor call on Tuesday (April 16) outlining its performance in Q1. On that same investor call, according to the letter, the company called on its shareholders to support a round of funding “in order to bring the company to profitability and sustainable growth”.

👆🏻Hot take: I feel for Proper/Utopia. The whole UK distribution business feels like a hot potato no one wants to full take ownership of, hence the need for investment (I would imagine anyway). Would you invest in Proper/Utopia based on its performance to date though? I certainly wouldn’t.

Notable stories from the world of tech:

TikTok warns millions of Americans would be censored if U.S. enacts a ban

Democratic Senator Mark Warner, chairman of the Senate Intelligence Committee, said on Sunday that TikTok could be used as a propaganda tool by the Chinese government, noting that “many young people” use TikTok to get news. “The idea that we would give the Communist Party this much of a propaganda tool as well as the ability to scrape 170 million Americans’ personal data, it is a national security risk,” he told CBS News.

👆🏻Hot take: as someone in the UK, I do feel there’s a fair bit of hypocrisy over the US’s concerns around TikTok, whilst pretty much all of Big Tech comprises US businesses sitting on infinitely more data of non-US citizens than anyone. But yeah, go ahead and ban it I guess. China = bad! Right kids?!

EU threatens TikTok Lite with ban over reward-to-watch feature

The EU has said it will ban a new service launched by TikTok in Europe that it believes could be “as addictive as cigarettes” unless the company offers “compelling” fresh evidence that children are safeguarded. If the ban goes ahead, it would be the first time the EU has used sweeping new powers to impose sanctions on social media companies since its landmark Digital Service Act (DSA) came into force last August.

👆🏻Hot take: rightly so too. This entire initiative feels like something out of Black Mirror to me. Everyone needs to come to their senses.

Substack rival Ghost confirms it will join the fediverse in 2024

Ghost, an open source rival to Substack’s newsletter platform, has confirmed it will this year officially join the fediverse — or the open social network of interconnected servers that includes apps like Mastodon, Pixelfed, PeerTube, Flipboard and, more recently, Instagram Threads, among others. Last week, the company teased its plans by surveying its users about how they may want federation to work.

👆🏻Hot take: a smart move here from Ghost. As Substack keeps introducing new features I would argue are NOT in line with that of the creators on the platform (specifically that Follow one), Ghost’s actions look all the more compelling.

Looking for something else to read? Here you go:

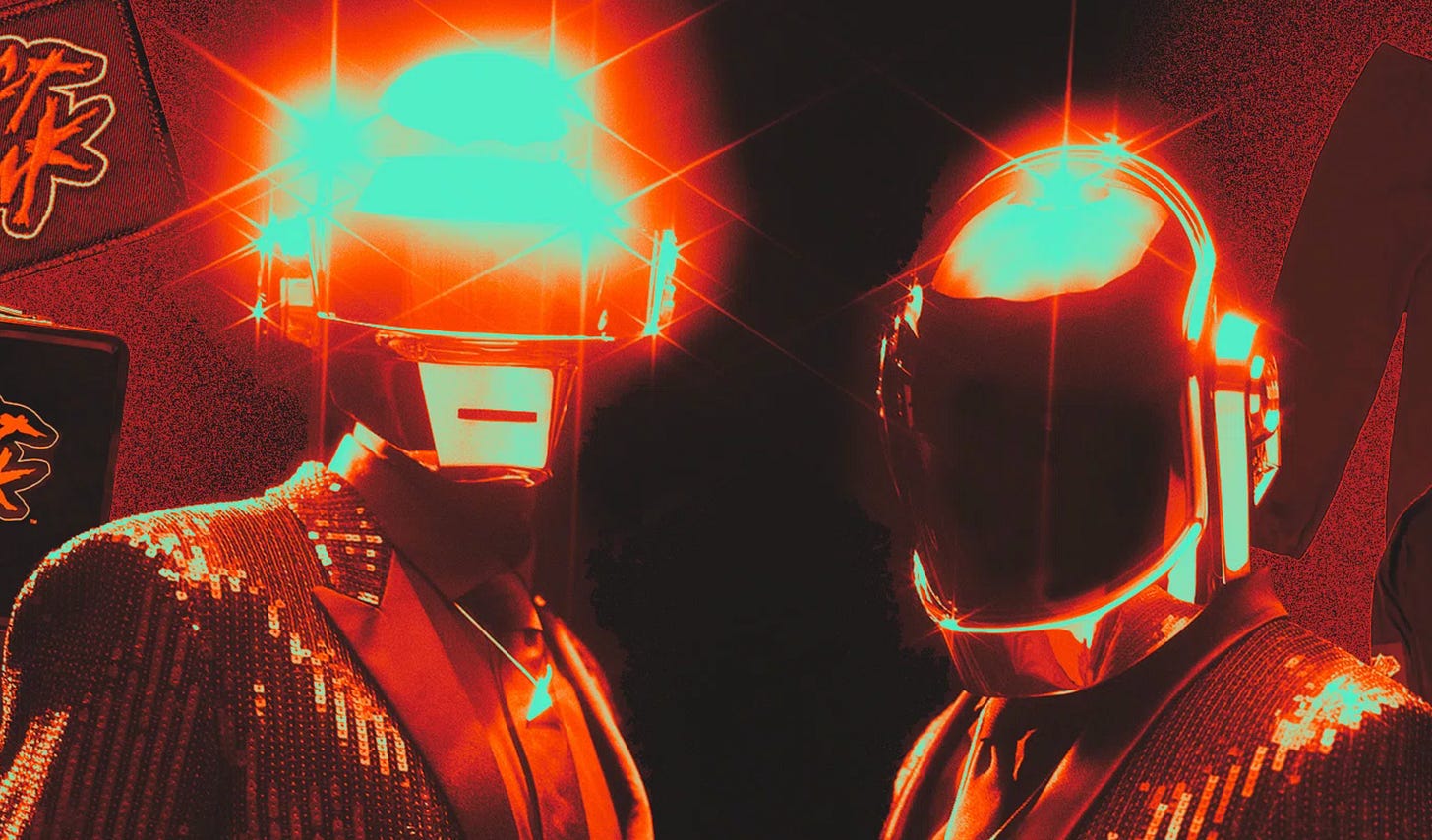

Daft Punk is dead, long live Daft Punk: the limits of a brand beyond the band

Daft Punk split up three years ago, but thanks to a near-constant stream of archival video releases, album reissues, merch drops and more, the robots feel more present than ever. But what are the limits to one of dance music's most iconic acts' prolific post-split existence? Will it start to wear thin? And what does it all say about the brand-focused and content-driven ecosystem we find ourselves in today?

👆🏻Hot take: a terrific piece from Ben Cardew looking at how Daft Punk’s legacy has been managed, and what challenges it might face for the future.

Hopeton Overton Brown is "The Scientist"

To watch him mix is like watching man and machine become one. His mixes are dance-like performances on the console, and the sound pictures he paints are mystical and dreamlike. I tracked Scientist down and had the pleasure of digging deeper with one of music's unique geniuses.Thanks for reading Network Notes! Subscribe for free to receive new posts.

👆🏻Hot take: as a HUGE dub fan, this was like catnip to me. Scientist is a great interviewee though, not being bashful in asserting his contribution to the artform but also talking passionately about how he works and why he feels digital trumps analogue every time.

I'd argue that it ain't more "gatekeepers" the present music landscape needs; there are already plenty on the "genre" level to provide decent quality control for the constituencies they serve.

What the present requires is, rather, more 'evangelism'; to make up for what space the Nostalgia Industrial Complex has taken away. Particularly, the sort of ad-hoc "connective tissue" between local/small-nation scenes who face challenges to grow and the increasingly remote and insular larger industry. There's too huge of a gap between the UMG and Sony "minor leagues" and these places and scenes that are growing and thriving, but limited on opportunities.

Where do you think Merlin fits into this picture?